Hybrid approach

Much is made of the electrification of the UK’s transport system. However, there is a quieter, but no less significant revolution happening in another area of clean transport – namely, hydrogen fuel cell vehicles. These vehicles have no waste product other than water vapor, are quick to refuel and have a range between refueling of hundreds of miles (for a bus, typically 200-250 miles).

In a hydrogen fuel cell, the clean burning compressed gas is converted first to electricity and then powers the bus, train or even aircraft or ship engine. So, the likely mainstream solution may be hybrid vehicles that can either take electric power from a direct source, or generate it from hydrogen combustion.

While the exact balance between grid-based electric power and hydrogen-based electric power is yet to be determined, 4what is abundantly clear is the fact that grid-powered and hydrogen-powered EVs will rapidly replace fossil fuel engines. Electric vehicles have far fewer moving parts and therefore offer a cost-of-ownership advantage over time because of their massively reduced maintenance costs. It is not surprising then, that a massive investment has already gone into electric and hybrid vehicle fleets.

The importance of a hydrogen-fueled future is neatly summarized by the European Union’s Mobility and Transport unit, which notes: “Hydrogen and fuel cell technologies were identified amongst the new energy technologies needed to achieve a 60 percent to 80 percent reduction in greenhouse gases by 2050, in the European Strategic Energy Technology Plan presented along with the Energy Policy Package.”

The breakthrough for hydrogen appears to be mainly happening in the field of transport, specifically buses. Hydrogen buses have been running routes in London since 2015 – eight hydrogen buses on the RV1 route with five refueling stations ran for eight years clocking up over a million miles. The world’s first hydrogen-powered double decker buses are to be working in Aberdeen this year, assuming no interruption from the Covid-19 crisis. This follows the city’s successful JIVE sponsored hydrogen bus project. Glasgow has also announced hydrogen bus initiatives within its overall clean transport investment plan. Wrightbus is now making the case for a £500m package from the government’s National Bus Strategy fund to help stimulate the UK’s hydrogen industry and support its plans to build at least 3,000 hydrogen buses by 2024.

All this planned development of hydrogen and electric fueled transport is well and good – but the question remains, how is it to be financed? The Covid-19 crisis has put enormous pressure on the Exchequer and, in any case, public capital is usually focused on pilot projects than full roll-out. Most green policymakers and consultants agree that private sector finance is critical to the creation of green, smart public services and cities. Siemens is directly pushing the hydrogen issue: it is one of 40+ companies that have written to the Chancellor calling for clearer hydrogen strategy; collectively the companies have stated themselves ready to invest £1.5 billion in hydrogen fuel projects.

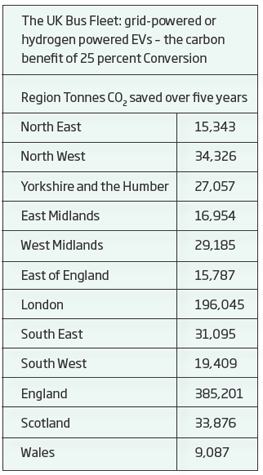

To give readers a sense of the carbon emissions benefit for conversion of the national bus fleet to grid-powered and/ or hydrogen-powered EVs, the report “Smart Financing and the road to zero” (2021) has modelled the carbon reduction gained from converting just 25 percent of the current fleet. The chart illustrates the benefits gained and underlines the importance of harnessing private sector capital to fund these acquisitions so that daunting capital expenditure is converted into a manageable monthly payment which does not tie up (or freeze) precious public funds.

In the light of economic pressures, private sector finance is essential to the great ‘green project’. So, what does that financing support need to look like? And where will it come from? First, it will tend to come from financiers who have an intimate understanding of the technology and its applications/benefits in real life. These financiers will tend to offer a range of financially sustainable financing methods, which address the multiple needs of green transport development. This will include finance to acquire the vehicles; finance that funds the development of charging or fueling infrastructures; and financing that allows existing networks to continue to run as new ones are tested and set up, but without having to pay for both at the same time. In big schemes, some financiers may even be prepared to build in targets that include environmental outcomes – such as improvement in air quality or energy consumption. The most appropriate financiers will also tend to have a track record of commitment and expertise in the area, whether that is financing the infrastructural development of smart cities, or a deep existing involvement in electric vehicle and charging infrastructure finance.

In short then, we can expect to see investment in electrification continue, but a hybrid approach, which combines electric with hydrogen, is seen by most policymakers and interest groups as the most cost-effective green transport strategy for both road and rail. The green transport sector will rely on a healthy supply side that is highly competitive, but also commercially sustainable, and smart finance plays a key role in making that possible. A healthy and strong supply chain ensures reliable supply, and the ability to provide added value to the buyside transport companies and – ultimately – their customers (us, the citizens!).

Brian Foster is Head of Industry Finance, Siemens Financial Services, UK (SFS). SFS – the financing arm of Siemens – provides business-to-business financial solutions. A unique combination of financial expertise, risk management and industry know-how enable SFS to create tailored innovative financial solutions. With these, SFS facilitates growth, creates value, enhances competitiveness and helps customers access new technologies. SFS supports investments with equipment and technology financing and leasing, corporate lending, equity investments and project and structured financing. Trade and receivable financing solutions complete the SFS portfolio.

www.siemens.com/finance

Access the research here: https://new.siemens.com/uk/en/products/financing/asset-finance/bus-and-coach-finance/funding-hydrogen-and-electric-veichles.html

For a list of references used in this article, please contact the editor